To remain successful as needs change and business insurance sector alone has had an average of more than 289,000 open

evolves, medical professional liability (MPL) carriers should reevaluate their traditional recruiting methods.

The overall U.S. unemployment rate dropped to a

near 50-year low in April, 3.6%, where it remained in May.

The category, insurance carriers and related activities, is experiencing even lower unemployment: 1%, in May 2019.

But despite this lack of available talent, the industry continues to add jobs. According to the Bureau of Labor Statistics, the finance and insurance sector alone has had an average of more than 289,000 open

jobs throughout the past 12 months. There’s not enough talent to meet the industry’s hiring needs—let alone supply the innovative and business-oriented minds needed to propel organizations toward

future success.

In brief, MPL carriers are challenged to expand their candidate pools and harness talent from outside of their immediate specialization to stay competitive.

Growing demand for talent

The talent crisis is impacting virtually every area of insurance. Baby boomers are retiring in droves, and a lack of industry awareness and interest among young professionals and recent college graduates makes recruiting new talent difficult. The candidate pool is shrinking, yet at the same time, the industry is projecting employment growth. According to the 2019 Q1 Insurance Labor Market Study,

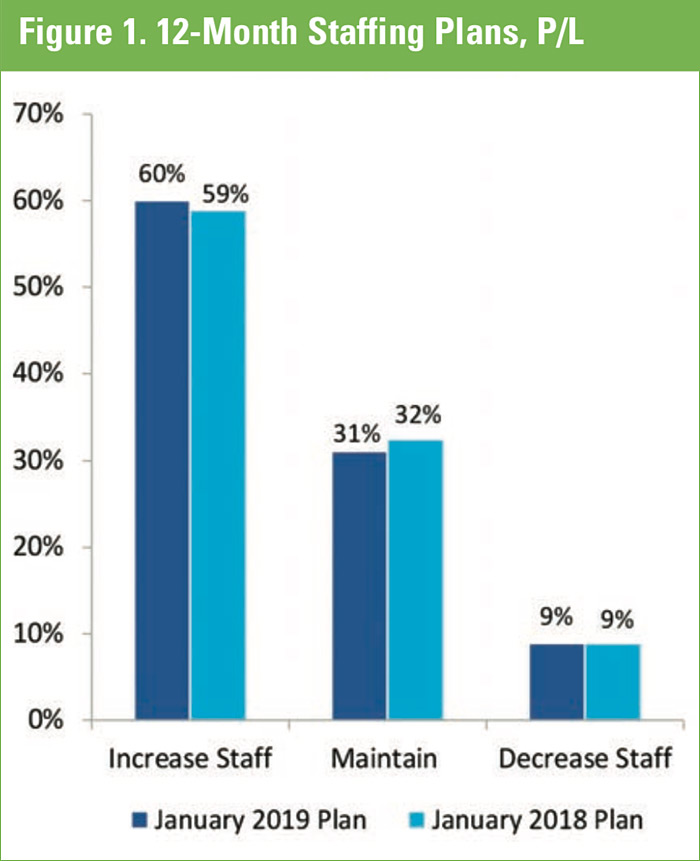

1 conducted by The Jacobson Group and Aon, the majority of property/casualty (P/C) carriers (60%) plan to increase their staff in 2019 (Figure 1). Thirty-one percent expect to maintain their staff size, while only 9% anticipate a reduction in staff. If the industry follows through on its plans, P/C employment will grow by 1.76% this year. For comparison, the sector grew by 1.43% from January 2018 to January 2019 and 0.84% from January 2017 to January 2018.

Within the broader insurance industry, half of study respondents credit expanding their businesses and venturing into new markets as the primary driver for staff increases. This is closely followed by an expected increase in business volume, which 49% of respondents cite as the main reason for adding staff. Of the organizations planning to reduce staff, most attribute the decrease to automation and reorganization efforts. With an increase in job openings, staffing expectations, and anticipated revenue growth, there are no signs that the tight labor market will be letting up any time soon.

As organizations evolve and modernize their teams and processes, it’s not surprising that P/C insurers

name technology roles as one of their

greatest hiring needs. An increased

focus on analytics and the rise of “the future of work” has made innovation and technological transformation necessary for every insurer looking to provide positive and efficient customer experiences. Unfortunately, technology tops the list as the most difficult type of position to fill within the sector.

MPL insurers in particular are likely to see a skills gap in technology-and innovation-related roles. According to a recent report from A.M. Best,

2 about 90% of MPL insurers believe that innovation can help overcome system and process challenges, yet only 4% have a team completely dedicated to innovation.Although MPL insurers are looking to invest more in innovation, a talent gap is one of the biggest obstacles. As MPL evolves to meet customers’ demands and expectations, while also

streamlining and automating time-consuming processes, employing individuals with these skill sets is essential to future success.

Techniques for staying competitive

in the tightening labor market

There are several ways MPL carriers can attract and retain the talent necessary to stay competitive in today’s candidate-driven market. Creating a positive candidate experience, offering an attractive compensation package and work culture, and committing to career opportunities and growth are all viable techniques. However, given the intensifying war for talent, one of the most crucial factors for long- term success is the ability to expand the talent pool by looking beyond traditional MPL candidates.

To achieve this, it’s important for MPL carriers to first determine what is, versus what isn’t, critical to employee success. Often, insurers are focused on finding individuals who have spent their whole careers within a particular specialty line. However, the MPL market is small, and looking only within its confines leads to a very limited candidate base. While these individuals often bring a vast amount of experience to the table, excluding candidates within other lines of P/C insurance can limit access to top talent, especially within the mid-level. It’s important for hiring managers to determine the critical traits and attributes for a hire, as opposed to the skills that can be learned or gained on the job.

For example, desired traits may include strategic vision, a growth mindset, ability to prioritize, and excellent communication skills. These characteristics are often innate and difficult to teach, yet have a direct correlation to

success—no matter the specialization. Additionally, leaders who are emotionally intelligent, influential, and agile will be successful in a multitude of environments and quickly gain respect from their team members, regardless of their backgrounds. An innate curiosity and desire to learn may make a more effective employee than someone who is less inquisitive, despite meeting all other experience requirements.

MPL is a unique specialization, yet other lines of insurance require similar attributes that may easily translate. For instance, MPL carriers have a duty to the medical industry and its providers, helping healthcare professionals practice medicine safely, and in a way that helps a vast population of individuals. Professionals who thrive within MPL are generally mission-oriented. Research has shown that mission-driven individuals are 30%3 more likely to be high performers than those who are primarily driven by money. Identifying individuals with a passion for mission-driven work can open up a fresh pool of talent for MPL organizations.

As a changing business environment and physician consolidation continue to threaten their profitability, many MPL companies have opted to diversify their service offerings. Consulting, training, and legal skills are becoming more desirable and have the potential to create value where specialty line experience is lacking. Technology and automation are also redefining the industry, making technological adeptness, agility, and communication skills more important than ever. Transferable skills are abundant in the greater P/C industry. However, unless they clearly define their needs and understand which attributes are vital to success, organizations may miss out on top talent.

Managers can interview for key attributes through open-ended behavioral questions that can reveal skill proficiency. For instance, questions may include: “In what ways do you guide your team to advance the goals of the organization?” or “How do you expand your value across the organization to exceed expectations for your division and company?” Responses to these and similar questions can provide insights on a candidate’s ability to prioritize and whether he or she can offer a mindset likely to foster growth, along with the individual’s capacity for strategic vision, coaching, and communication. Strengths in these areas are often more telling of future performance and abilities than a certain number of years working in MPL.

In the current employment climate, defining transferable skills and translating those skills to MPL is key to maintaining a strong and viable talent pool. The companies that will continue to grow and innovate are likely those that open their searches to the greater P/C market. MPL carriers must look beyond candidates’ specific experience and, instead, focus on the particular skills that are necessary for driving

future organizational success.

References

1. 2019 Q1 U.S. Insurance Labor Outlook Study Results, The Jacobson Group.

2. Medical malpractice insurers under pressure: Best, Business Insurance, May 7, 2019.

3. The Importance of Having A Mission-Driven Company, Forbes,

May 18, 2018.