After more than a decade of a soft market, evidence points to a medical professional liability market transitioning into a new phase. There’s little evidence to indicate a rapid movement

into the type of tumultuous hard market of the early 2000s, with rates spiking and physicians driven out

of practice. Today, insurers are responding to an increase in large claims with additional exclusions, capacity management, and premium increases. For healthcare professionals, this translates to a need to seek coverage from more insurance providers.

Since 2007, medical professional liability coverage has been widely available at affordable rates. Many providers formed captives to better control costs, a move which largely succeeded. However, both the insurance and provider landscapes have shifted significantly since the end of the last hard market, creating uncertainty as to how the firming market will play out over the next few years.

Whether you want to call this a hardening, firming, or transitioning market, there’s no doubt that a more challenging medical professional liability market lies ahead in the 2020s. Insurers must navigate the market carefully to avoid compromising their balance sheets. Providers must attempt to read the tea leaves for rate increases and availability to ensure budgetary and coverage accessibility going forward.

“I would definitely say that the market is hardening but that we are probably not yet in a hard market,” said Holly Meidl, vice president, risk services at Ascension, the largest U.S. nonprofit hospital system.“ At the moment coverage and capacity are still available. Insurers are limiting the types of policies they write as well as cutting the amount of coverage and signaling rate increases. I can understand this, because the market won’t sustain itself at the current level. Adjustments in rates will create a sustainable, healthy market for the future.”

Rising claim severity

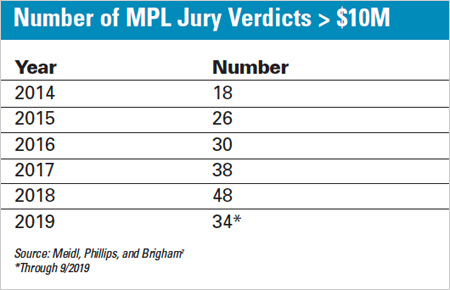

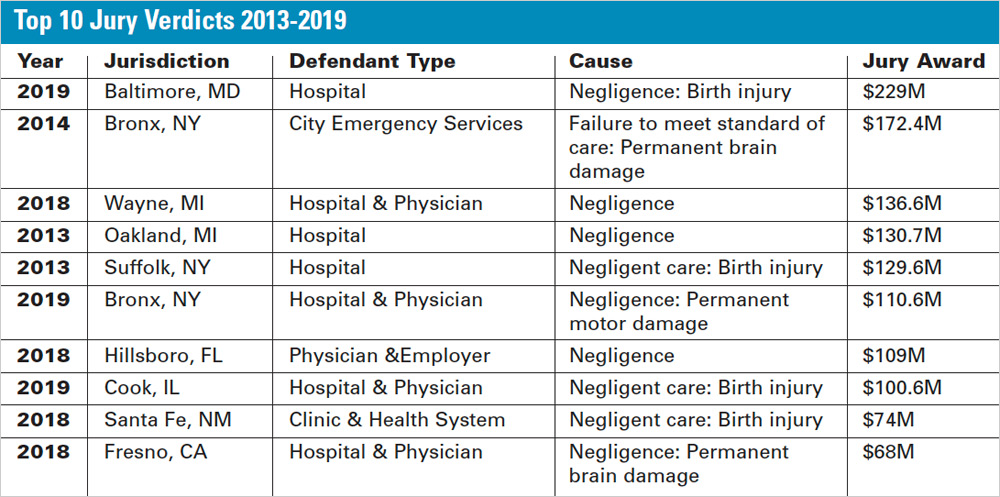

There’s little doubt that rising claim severity is driving the firming market. In 2019, more than 30 verdicts in excess of $10 million generated an aggregate total of more than $1 billion in medical liability verdicts. While 2019 represented a decline in the number of $10 million and over verdicts, the underlying trend reveals that the number of large verdicts continues to increase.

The top of hospital professional liability claims accounted for an increasing percentage of total loss amounts:

- The top 25% of total claims accounted for 90% to 95% of total loss

amounts

- The top 10% of total claims accounted for 75% to 80% of total loss

amounts

- The top 3% of total claims accounted for 50% to 55% of total

loss amounts.

Recent market analysis noted that the average number of claims greater than $7 million has more than doubled in recent years. That means that larger claims continue to dominate the market. Claim amounts greater than $1 million represented 58% of the market between 2016 and 2018, an increase over the 52% that they represented between 2006 and 2015.

In the wake of the last hard market, tort reform, along with major advances in risk management and patient safety, dampened the frequency and severity of medical malpractice verdicts. However, during the past decade, some of those reforms have been overturned or diluted in various states. In addition, plaintiff ’s lawyers have employed increasingly sophisticated tactics to boost their clients’ cases, according to Jim Hurley, an actuary with Willis Towers Watson.

As the frequency and severity of large claims rise, the profitability of insurers is eroding, noted Chad Karls, principal and consulting actuary with Milliman.“ Often, a deterioration in profitability of the claims environment is what triggers a hardening of the market,” he said.“ In certain states, we’re observing the number of claims per physician rising after a long period of time where claim frequency trended downwards.”

Shifting markets

In this evolving market, the significance of eroding profitability and rising claim severity argues that a shift is underway after one of the longest, softest markets in recent history. Hurley noted that “inadequacy in pricing, combined with the inability to fund coverage year short-falls with diminished reserves, translates to unprofitable results.”

Neil Morrell, CEO of MagMutual, a medical professional liability insurer, prefers to describe the current market environment as correcting rather than hardening or firming. “While losses are going up, capital is not shrinking,”he noted.“A hard market implies a market where prices are higher than necessary to both cover the losses and expenses associated with medical professional liability coverage and capital depletion contributions also. We are in a phase of the market where insurers are starting to price their product in

line with the loss and expense trend increases

they have experienced. But they haven’t yet

priced in significant capital contributions.”

The recent arrival of new entrants in the market means that capacity has not become an issue as it was during the previous hard market, Meidl said.

“These new entrants got in the market to ride this upswing in rates while benefiting from the fact that they don’t have legacy claims,” she continued.“They will be eager to write new coverage and will be able to do so for the foreseeable future.”

While the overall trend points toward a firming, Karls cautioned MPL stakeholders against viewing the market as a monolith.“There is no single MPL market—instead, there are 50 individual markets,” he said.“That being said, it does seem that the market is swinging from softer to harder as some states experience firming prices.”

Five Factors Contributing to the Firming Market

Adiverse set of circumstances creates a

far different environment than the last hard market. These factors include

- stronger insurance balance sheets,

- tort reform erosion,

- growth in captives,

- medical provider consolidation, and

- uncertain reimbursement trends.

Stronger balance sheets—A major difference between the current market and the hard market in 2002-06 is that insurance company balance sheets are in much better shape, Chad Karls, consulting actuary at Milliman, said. “There are many companies with very strong balance sheets that are as strong as they have ever been,” he stated. Companies with a stronger financial position have more financial heft to navigate the hard market, providing incentives for sound decision-making regarding rate increases and market share with an eye to preserving that financial strength.

Tort reform erosion—In the wake of the last hard market, tort reform succeeded in many states in limiting awards in medical professional liability cases. However, noneconomic damage caps and other tort reforms have been challenged in a number of states, resulting in reversals in some state courts as well as action in state legislatures to dilute or eliminate reforms. Karls added that plaintiff attorneys are more frequently using life care plans, which document the total cost of damages caused by a medical-related injury or death and can result in higher economic damage awards.

Growth in captives—Fueled by the last hard market, captives are increasingly popular for managing medical professional liability. In fact, many hospitals and health systems utilize some type of captive for medical liability risk management. However, while captives appear to have had success containing costs, their success has occurred within the context of an extended soft market, Neil Morrell, CEO of MagMutual, noted.“Many captives have been making capital contributions to their organizations, a trend which will likely change as the market transitions,” Morrell said.

Medical provider consolidation—

Consolidation in the healthcare market is continuing. Since the last hard market, a pronounced shift has occurred as hospitals buy up medical practices, medical practices combine, and large hospital chains acquire smaller hospitals. At the same time, consolidations have meant that physicians are employed by market groups, larger practices, hospitals, and health systems, creating an evolving market dynamic for traditional insurers, captives, and other entities.

Uncertain reimbursement trends—

Changing reimbursement mechanisms create challenges for providers, especially as more healthcare providers consolidate. “Hospitals are acquiring physician practices and other hospitals, while physician groups are also merging,”said Jim Hurley, an actuary at Willis Towers Watson.“Everyone is impacted by changes in reimbursement dollars, which means that rising costs of any type are a bigger deal.”

Proactive tactics for navigating a firming market

While there is no crystal ball to predict exactly how the firming market will take shape over the next several years, experts consulted by Inside Medical Liability offered potential strategies for managing a response to transitioning market conditions.

Strategies for insurers

- Invest in technology—The insurance industry has under invested in technology designed to streamline operations and leverage data. In a 2018 special report on innovation, AM Best reported on the results of a survey that found that most of the insurance executive respondents

believed that the MPL industry was lacking in innovation.3 Karls stated, “The industry’s very strong balance sheets mean that they have the ability to make investments in technologies that can provide a competitive advantage. Many also have a history of long relationships with their customers, which provides them with data that confers an information advantage.” Leveraging their capital to hire skilled professionals who can use the technology to their advantage is imperative, Karls said.

- Raise rates carefully—Because medical professional liability rates are so backward looking, it’s difficult to gain appropriate rate visibility, Morrell said.“It takes five years or so to know whether your price is right or not—which means you tend to unintentionally overcharge or undercharge and rarely get it exactly right,”he noted.“ Claims and lawsuits take years to resolve. Despite this issue, I believe it’s incumbent on the industry—especially the mutuals—to price appropriately as the market transitions and not raise rates just because we can.”

- Select risks carefully—As the market transitions, insurers need to gain more selectivity in assuming risk, Hurley stated. “Companies should ensure that their risk selection is commensurate with the rate level they can achieve, ”he continued.“It’s important to balance capturing and retaining market share with appropriate risk and rate management due to the tremendous changes the industry has undergone since the last hard market.” In other words, if a company must erode its balance sheet to retain market share, it should proceed with care.

- Keep a long-term view—During the last hard market, insurers hiked rates rapidly because conditions changed quickly. This time, the market is moving more slowly and insurers are in better financial shape, which gives both insurers and providers time to adjust to the new dynamics.“Most insurers know what their ideal ratio is,” said Morrell. “At MagMutual, we’re probably a few years away from reaching our optimal price. Increasing rates slowly to achieve that goal is ideal, because it’s more fair to our policyholders and gives everyone time to adjust.We will also continue to give back dividends to offset any increases which, with hindsight, prove too high.”

- Maintain financial well-being—Navigating the firming market involves retaining as much financial strength and flexibility as possible, Hurley said.“If you don’t do a good job of addressing the shifting market your financials will suffer,”he noted.“Because most companies are in good shape now, it’s unlikely that there will be much serious damage, for example, an inability to meet claim obligations, in the short term. However, financial erosion could definitely occur in the long term.” Morrell agreed that insurers must maintain their financial well-being, saying that insurers must keep their ratings in mind and ensure that they maintain appropriate reserves and pricing to support those ratings.

- Communicate with your insurer—“The first step I recommend is communicating with your insurer or broker to find out how they are responding and what type of increase you can expect when you renew,” Meidl recommended. “We just went into budget season, so I talked to our agents and carriers so I know what to expect.” Many busy health-care executives and physicians don’t necessarily have the time to engage in this practice, and may be caught off guard by increases, necessitating a last-minute scramble for alternative coverage.

- Educate your leadership—For hospitals and health systems, before the budget season make sure your company’s leadership realizes what’s happening in the larger market. That means you need to have conversations with agents, carriers, and your peers to get a firm perspective on the market.“Showing your leadership how your carrier’s average claim payments are jumping and how large medical malpractice verdicts are climbing helps contextualize any premium increases that may occur,” Meidl said.

- Research claims history—Meidl recommends gathering your claims data and sharing it up the chain of command at your company to facilitate understanding of how your organization is positioned with claims and losses.“Your data speaks volumes and helps everyone understand your history,” she said.“You can get information from your agent and carrier to provide some perspective of where your organization is relative to the market and show how your premium is increasing versus the industry.”

Stay informed

The transitioning medical liability market will continue to take shape in 2020 and beyond. To stay up-to-date about the latest news, analysis, and trends, consult the MPL website and coming quarterly issues of Inside Medical Liability.We plan to explore a variety of issues related to the market both in this magazine and on the website.

References

1. “MPL Industry Results Improved in 2018 But Challenges Remain,”AM Best, May 6, 2019, http://www3.ambest.com/bestweekpdfs/sr497757919749afull.pdf.

2. “HPL Hard Market—How to Stop It From Keeping You Up at Night,” Cayman Captive Forum, December, 2019, Meidl H., Phillips D., Brigham J.