Driven by favorable structural factors and declining rates, the U.S. real estate market looks to carry forward its stable returns into 2020. During the last four years, returns, vacancies, and net operating income have been stable or increasing. In 2019, total returns of 6.4% were within the 6%–7% range that has prevailed since mid-2017.

Based on low rates and favorable economic conditions, real estate investment performance is likely to remain buoyant and may even pick up somewhat in 2020. Although trade disputes have weighed on exports and business investment, low unemployment and interest rates should underpin housing and consumer spending. Exports and business investment make up 25% of GDP and consumer spending makes up 70% of GDP.1,2 These components should sustain the economy and create occupational demand for real estate. Meanwhile, supply should continue to gradually unwind from its 2017 peak.

Vacancy rates are expected to remain historically low, promoting sturdy net operating income (NOI) growth. Low interest rates might also attract additional capital into real estate from various sources, including leveraged private investors and yield-seeking institutions, fueling increased transaction activity and price appreciation.

The coronavirus slowdown in the mid-first quarter of 2020 and the drop in interest rates are symptomatic of potential risks in terms of a potential American and global recession. Despite these risks, the real estate market is well positioned to withstand adverse economic conditions. As an asset class, U.S. real estate is an attractive investment destination for medical professional liability (MPL) capital, especially due to its income-producing potential.

Current state of U.S. real estate market

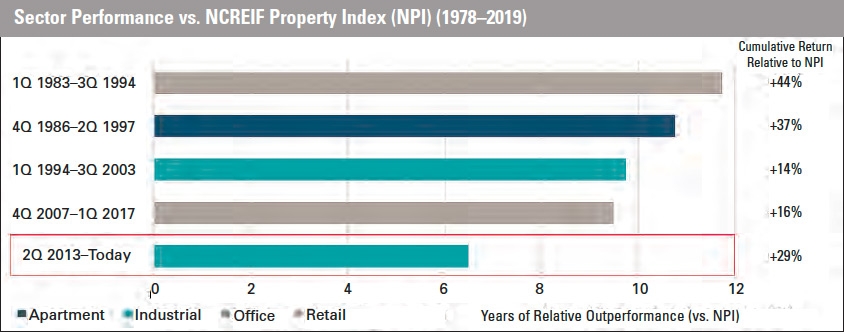

From the fundamental perspective, vacancies remained near a 30-year low while NOI increased nearly 5%. That being said, favorable top-line numbers masked sharp disparities; the gap between the best- and worst-performing sectors—industrial and retail—reached its widest level in 25 years while notable divergences occurred across sub-sectors and geographies.3

The U.S. real estate industry is in a strong financial position, supported by strong pricing, low delinquency rates, and strong balance sheets. In terms of real estate debt, total returns for the Giliberto-Levy (GL) senior mortgage index climbed to 8.4% in 2019, their highest level since 2010, as sliding Treasury yields boosted valuations of fixed-rate debt.4 Non-agency commercial mortgage-backed security (CMBS) spreads continued to hover around 90 basis points, well below their 20-year average, which is 200 basis points, and only slightly above their pre-crisis low, which is 60 basis points.

The strong pricing evident over the past several years is in part a reflection of healthy debt service conditions: Delinquency rates remained near-record lows for bank and insurance company loans (0.7% and 0%, respectively) and below historical averages (and heading lower) for CMBS loans (2.9%).5

In the near term, capital infusions stemming from low interest rates might temporarily suppress divergent performance trends within the overall market. However, disparities may ultimately resurface, favoring property with robust underlying structural (rather than cyclical) drivers. This includes the industrial sector (supported by e-commerce) as well as technology- and growth-oriented markets.

From the capital market perspective, real estate valuations experienced volatility due to market swings. Average mortgage rates for commercial and multifamily properties tumbled from 5.3% in December 2018 to 3.9% in November 2019.6 Listed equity real estate investment trust (REIT) prices jumped 24% during the year.7 Real estate equity transaction volume of $571 billion was only slightly below the 2018 total ($580 billion) and near a record high.8

Favoring the U.S. real estate sector, capital markets will likely remain liquid and positive for valuations in 2020. In isolation, low interest rates and buoyant equity markets can provide support through multiple channels. These include domestic institutions rebalancing mixed-asset portfolios and seeking yield alternatives, private leveraged investors capitalizing on lower borrowing rates, foreigners paying less to hedge dollar exposure, and listed REITs with higher share prices that deliver a lower cost of capital.9

Capital markets may cool when the economy and real estate fundamentals soften. However, we believe that transaction markets will remain active to the tune of about $500–$600 billion annually. Cap rates should remain stable in 2020, with downward pressure in some areas, such as industrial, offsetting upward pressure in others such as retail.

Real estate market risks

To be sure, the drop in interest rates that has helped to bolster our near-term outlook is also symptomatic of medium-term risks. If history is a guide, the yield curve’s inversion through the summer raises the specter of a recession in one or two years. While the curve steepened in the final months of 2019, this typically occurs in the later stages of a cycle when the Federal Reserve loosens policy.

A recession would likely dent property demand. Yet relative to past cycles and, indeed, many investment alternatives, U.S. real estate appears well positioned to withstand adverse economic pressures thanks to a moderate supply pipeline, reasonable valuations (relative to interest rates), and manageable debt burdens.

Source: National Council of Real Estate Investment Fiduciaries (NCREIF). As of December 2019. Forecasts are not a reliable indicator of future performance.

Forecasts are based on assumptions, estimates, views, and hypothetical models or analyses, which prove inaccurate or incorrect.

Source: National Council of Real Estate Investment Fiduciaries (NCREIF). As of December 2019. Forecasts are not a reliable indicator of future performance.

Forecasts are based on assumptions, estimates, views, and hypothetical models or analyses, which prove inaccurate or incorrect.

Benefits from investing in real estate

From an asset class perspective, insurance investors can continue to realize positive opportunities from allocations to private real estate in their general accounts. Income generated through NOI cash flow in the form of dividends can exceed 3% in core strategies. There are also significant correlation benefits that can be reaped as private real estate is negatively correlated to fixed income while having a low correlation to U.S. equities.10 Taking into account real estate’s historical return profile and measured by its standard deviation, insurers can potentially realize improved returns per unit of risk in their portfolios when adding the asset class.

This can present a good opportunity for MPL companies to potentially increase returns. Several MPL companies have already been incorporating real estate in their allocations as seen from SNL statutory data through year-end 2018. These companies appear to be looking beyond traditional bonds and stocks, making good investment use of recent surpluses to expand into more specialty fixed-income and alternatives. While profitability in this segment has been strong, analysis is indicating it can be getting more challenging, which could mean increased emphasis on investments to help drive operating profit. This could therefore translate into an increasing number of MPL companies looking to further expand their investment profile into income-producing areas like real estate

References

1 Martin Crutsinger. “Thanks to consumer, the US economy is still rising steadily.” USA Today, Aug 29, 2019. https://www.usatoday.com/story/money/2019/08/29/gdp -up-2nd-quarter-consumer-spending-rises-us-economy-slows/2150057001. Accessed Feb 10, 2020.

2 Kimberly Amadeo. “Components of GDP Explained,” TheBalance.com, Jan 30, 2020. https://www.thebalance. com/components-of-gdp-explanation-formula-andchart-3306015. Accessed Feb 12, 2020.

3 “Commercial Real Estate Returns End the Year on a High Note,” National Council of Real Estate Investment Fiduciaries, Jan 24, 2019. https://www.ncreif.org/news/ npi-4q2019. Accessed Feb 11, 2020.

4 “Gilberto-Levy Commercial Mortgage Performance Index.” John B. Levy & Company. https://jblevyco.com/ index. Accessed Feb 12, 2020.

5 Data from Moody’s Analytics, Dec 2019. https://www. moodysanalytics.com. Accessed Feb 10, 2020.

6 “Mortgage Debt Outstanding.” Board of Governors of the Federal Reserve System, Mar 13. 2020. https://www. federalreserve.gov/data/mortoutstand/current.htm. Accessed Feb 12, 2020.

7 “Annual Index Values and Returns.” NAREIT. https:// www.reit.com/data-research/reit-indexes/annual-indexvalues-returns. Accessed Feb 10, 2020.

8 Data from Real Capital Analytics, Dec 2019. https:// www.rcanalytics.com. Accessed Feb 11, 2020. See also Bloomberg

9 Data sources: RREEF Management LLC, Dec 2019. https://www.rreefpropertytrust.com. Accessed Feb 11, 2020. See also Real Capital Analytics, Dec 2019. https://www.rcanalytics.com.

10 For fixed income, the Bloomberg Barclays Aggregate. https://www.bloomberg.com/markets/ratesbonds/bloomberg-barclays-indices. Accessed Feb 10, 2020. For public equity, the Russell 1000. https://www. ftserussell.com/products/indices/russell-us. Accessed Feb 10, 2020. For the non-IG indices, see BloombergBarclays. https://www.bloomberg.com/professional/ product/indices/bloomberg-barclays-indices. Accessed Feb 10, 2020.

Important information:

DWS and MPL are not affiliated.

For Institutional investor and Registered Representative use only. Not to be shared with the public. The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas Inc. and RREEF America L.L.C. which offer advisory services.

The material was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. It is intended for informational purposes only and it is not intended that it be relied on to make any investment decision. It is for professional investors only. It does not constitute investment advice or a recommendation or an offer or solicitation and is not the basis for any contract to purchase or sell any security or other instrument, or for DWS and its affiliates to enter into or arrange any type of transaction as a consequence of any information contained herein.

Please note that this information is not intended to provide tax or legal advice and should not be relied upon as such. DWS does not provide tax, legal or accounting advice. Please consult with your respective experts before making investment decisions.

Neither DWS nor any of its affiliates, gives any warranty as to the accuracy, reliability or completeness of information which is contained. Except insofar as liability under any statute cannot be excluded, no member of DWS, the Issuer or any officer, employee or associate of them accepts any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission or for any resulting loss or damage whether direct, indirect, consequential or otherwise suffered.

This document is intended for discussion purposes only and does not create any legally binding obligations on the part of DWS and/or its affiliates. Without limitation, this document does not constitute investment advice or a recommendation or an offer or solicitation and is not the basis for any contract to purchase or sell any security or other instrument, or for DWS to enter into or arrange any type of transaction as a consequence of any information contained herein. The information contained in this document is based on material we believe to be reliable; however, we do not represent that it is accurate, current, complete, or error free. Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Past performance is not a guarantee of future results. Any forecasts provided herein are based upon our opinion of the market as at this date and are subject to change, dependent on future changes in the market. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. Investments are subject to risks, including possible loss of principal amount invested.

© 2020 DWS GmbH & Co. KGaA. All rights reserved.