The hospital professional liability (HPL) market is facing a confluence of issues that are impacting rates right now, including tail, social and economic inflation, and consequent reserving challenges. A clear understanding of these factors and their potential impact, both short and long term, is essential for US hospitals, their brokers, and the carriers who insure them.

Long-tail Claims Present Variation in Timeline and Path to Closing

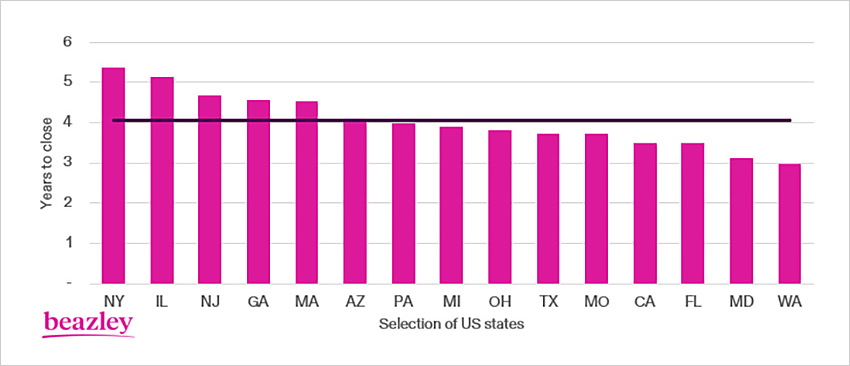

HPL is a long-tailed class of business, which means that it can take many years from when a claim is first reported to reach the point of closing and final payment. For larger claims of $1 million or more, this process takes approximately four years on average, though individual cases may extend to 10 years or more.

Chart 1: Average time to close, by state, for $1m+ HPL claims. Source: Beazley HPL claims from 2010–2022.

One common example of high value claims that can take a particularly long time to close is birth injury claims. Given the often-catastrophic nature of injury suffered, the timeline for these can vary significantly. Sometimes coverage will be triggered when an adverse outcome at birth is reported as a potentially compensable event, though a subsequent lawsuit may not be filed for years afterward. Other times, it can take many years for injuries to become apparent. The maximum statute of limitations can run for up to 21 years in some states as a result, however most lawsuits are typically filed much sooner.

There is variation in how excess insurance coverage responds to birth injury claims. Take for example a health system that recently had two similar birth injury claims. Baby A was delivered in 2008. A potentially compensable event was reported the next day, triggering coverage on the 2008 policy, and a lawsuit was eventually filed in 2019. The trial took place in 2022, resulting in a plaintiff award. Baby B was also delivered in 2008, but no potentially compensable event was logged at the time. In 2021, a subsequent claim was made when a lawsuit was filed. The claim settled at mediation in 2022. These cases are a perfect example of how two very similar sets of dates can follow an entirely different timeline to claim completion.

Another common group of high value claims with long tail are those involving multiple patients, or what are known as “related medical incidents.” These are somewhat dependent on policy language and fact pattern, but examples might include a surgeon incorrectly performing a procedure on multiple patients, or contaminated medical equipment that infects multiple patients.

Related medical incidents can often develop quickly, but discovery can be long and complicated—and costly—when many potential claimants are involved. The tail can also be exacerbated further on this kind of claim if there is ambiguity in policy language. The worst examples occur when individual incidents are reported in multiple policy periods yet a “related claim” is only identified and made years later, at which point all of the claims may attach back to the first impacted policy. Delays in the identification of a related claim can also have a negative impact on patient care because of the potential for associated delays in mitigation and prevention efforts.

The Dangers of a Long Tail

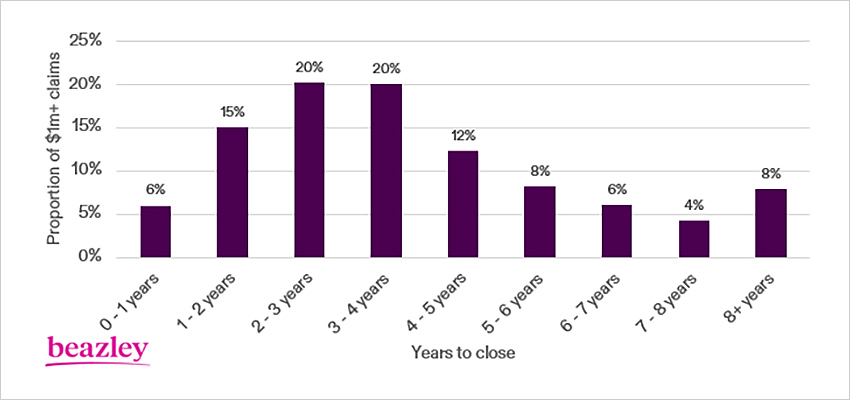

As frustrating as delays can be for all parties involved, tail is particularly dangerous for underwriters because claim costs tend to only increase over time. Underwriters writing policies in 2023 must anticipate what claim values will look like when the claims that are made in policy year 2023 ultimately settle, which on average will not be until 2028. They must also factor in the possibility that settlement could be much later; Chart 2 shows that while the average time to close is four years, 8% of $1 million-plus claims nationally take eight years or more to resolve.

Chart 2: Distribution of time to close for $1m+ HPL claims. Source: Beazley HPL claims from 2010–2022.

Tail can be even longer for underwriters on high excess layers than for those underwriters who write predominantly primary layers. They are not only exposed to very large claims, but they may also drop down when underlying limits are exhausted over time.

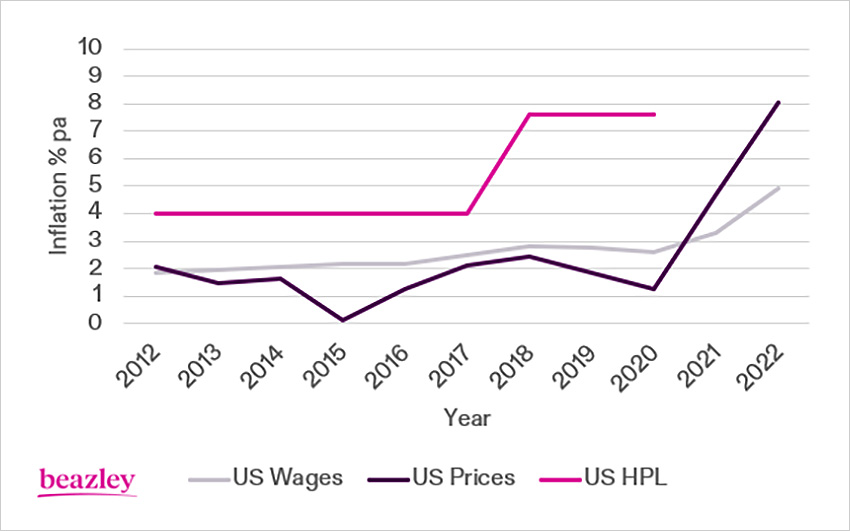

Underwriters Must Anticipate Inflation

Given the length of time involved in HPL claims, it is crucial for long-tail underwriters to correctly price for future inflation. On short-tail lines with a one-year average time to close, if inflation is assumed at 5% and it actually turns out to be 8%, the underwriter is only 3% wrong. If a long-tail underwriter makes the same mistake on a claim with a four-year average time to close, the underwriter is ultimately 15% wrong. A short-tail underwriter also has the benefit of being able to correct their mistake at the next renewal when claims develop, whereas the long-tail underwriter may repeat these mistakes for the next three to four renewals before the issue becomes apparent.

Chart 3: US HPL has historically run at 2% per annum above US wage inflation.

US HPL inflation increased from 2018 owing to social inflation. Future US HPL inflation is uncertain given economic inflation pressures. Source: US Wages: Employment Cost Index, US prices: CPI-U, US HPL: Beazley HealthRate database, inflation trend calculated from $1m+ closed US HPL claims. 2021-22 dataset incomplete.

Given that US price inflation peaked at 9.1% in June 2022 and the US Employment Cost Index increased to 5% in the fourth quarter of 2022, and that HPL claims are a function of future supplies and services (plus noneconomic heads of damage, such as pain and suffering), it is safe to anticipate that future HPL claims will increase in value similarly.

Social Inflation Further Complicates the Equation

A much trickier component to quantify is that of social inflation, which encapsulates how insurers' claims costs increase above general economic inflation. There has been a rise in anti-corporate sentiment across the board in US courtrooms, and healthcare—like all industries—is feeling the impact. US hospitals have experienced huge consolidation in recent years, with Kaufman Hall reporting more than 1,100 announced hospital transactions between 2010-2022, and this is influencing perception: US jurors are increasingly regarding even not-for-profit health systems as large corporations with huge balance sheets and well-paid CEOs and are regularly bestowing large awards against them as a result.

With the rise of social inflation over the past five years, compounded by ongoing heightened economic inflation over the past two years, historical under-pricing is now apparent and will take time to quantify. As underwriters write new policies in 2023, the inflation outlook remains uncertain—no one knows how quickly economic inflation will return to normal historic levels, and social inflation shows few signs of slowing down. With a double-digit inflationary impact on portfolios, underwriters must charge a corresponding premium increase just to keep pace with the claims environment.

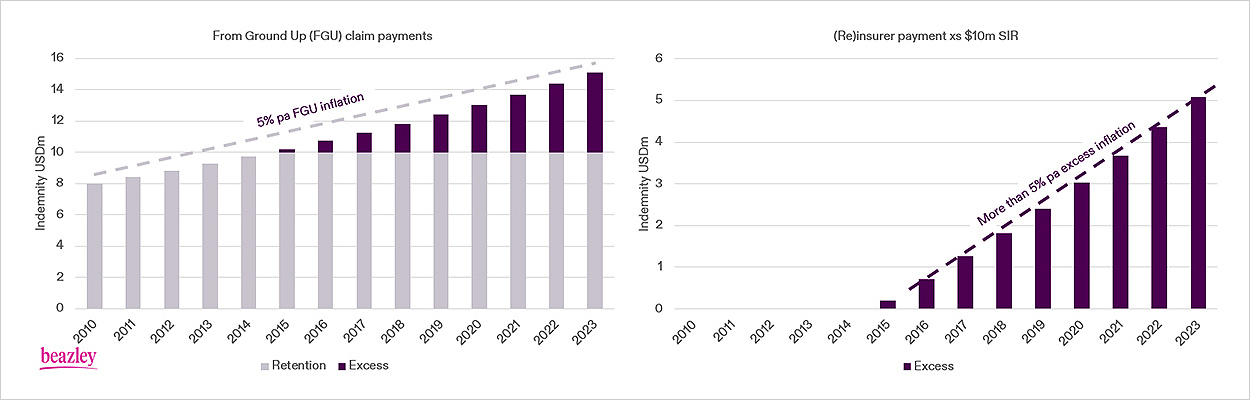

Self-insured Retentions Have a Gearing Effect

Another concept that impacts excess underwriters is the gearing effect of significant self-insured retentions, as illustrated in Chart 4. Many hospital retentions remained stubbornly flat through 2004-2018, not increasing with annual inflation, and excess towers therefore felt an increased rate of claim activity. Because hospital claims are capped by either the per claim retention or aggregate retention, this gearing effect suppresses the inflationary impact of claims. That means that although inflation appears to be moderate as experienced by the end client, inflation is actually occurring at a higher level for the excess underwriter. Underwriters continue to try to quantify the resulting impact.

Chart 4: Illustration showing the gearing effect of inflation on excess insurers.

An $8m claim in 2010 will grow in value over time owing to inflation. With a fixed $10 million self-insured retention (SIR), the inflationary impact on excess (re)insurers is greater.

Twenty years ago, there were many factors present to mitigate rising HPL claim costs, including better risk management, successful tort reform, and increased retentions. There is less obvious scope for improvement in risk management and retentions today, and little appetite in the present environment to enact material tort reform. It is therefore reasonable to expect continued HPL inflation.

Looking Ahead: Reserving Issues Present Uncertainty

High value HPL claims have always been complex, requiring a great deal of clinical and legal expertise to manage them effectively. It is challenging to determine robust early reserves, which serve a dual purpose to insurers of identifying potential excess exposure and managing it appropriately, as well as informing underwriters in a timely manner about retentions and pricing.

Given this difficulty, it is our belief that the HPL market is under-reserved. Reserve deteriorations could be significant because actual inflation is likely much higher than assumed inflation, and due to the long tail, it takes a long time to recognize this bad news. We anticipate a major correction in market pricing in the future as a result.

There can also be significant uncertainty around the exact level of reserve funding necessary, especially when trying to assess the value of a claim that will potentially not resolve for years. It is often a slow process to value a case fully, and reserves escalate quickly prior to the point of settlement. The severity potential for mismanaged claims in the current environment makes it crucial that hospitals, counsel, and reinsurers exchange information effectively and realistically evaluate claim value in order to defend those cases appropriately.

With market conditions likely to persist for some time, it is reasonable to expect the pace of price increases to accelerate further as underwriters continue to recognize that the excess HPL marketplace is under-priced. A carrier partner with a solid grip on these issues can be an important support as we collectively work to explore claim management strategies to combat rising severity.

The information set forth in this document is intended as general risk management information. It is made available with the understanding that Beazley does not render legal services or advice. It should not be construed or relied upon as legal advice and is not intended as a substitute for consultation with counsel. Beazley has not examined and/or had access to any particular circumstances, needs, contracts, and/or operations of any party having access to this document. There may be specific issues under applicable law or related to the particular circumstances of your contracts or operations for which you may wish the assistance of counsel. Although reasonable care has been taken in preparing the information set forth in this document, Beazley accepts no responsibility for any errors it may contain or for any losses allegedly attributable to this information.