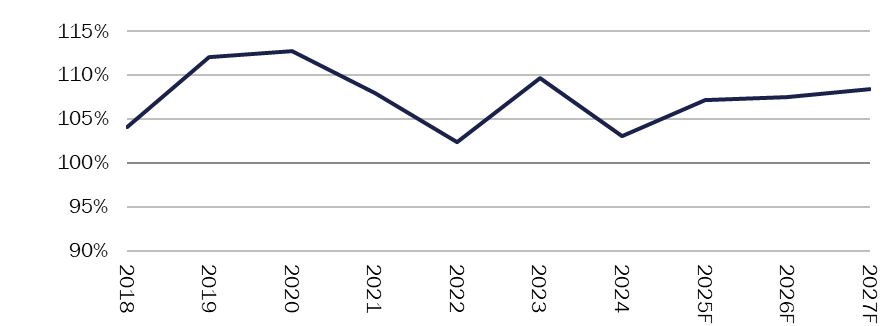

Several years of consecutive underwriting results have been challenging for the medical professional liability (MPL) industry. We expect to see rate increases to persist as social and medical inflation continue to pressure profitability. However, Conning does not anticipate a meaningful improvement in profitability over the 2025-2027 forecast period (illustrated in Figure 1) as:

- Severity continues to increase with larger verdicts and inflation

- Frequency stabilizes over the next few years

- Exposures decrease steadily

Figure 1. Medical Professional Liability Insurance Combined Ratio

Prepared by Conning, Inc. Sources: Copyright 2025, S&P Global Market Intelligence LLC and ©2025 Conning, Inc.

Even in a challenging underwriting environment, carriers can strengthen their position by enhancing their investment strategy. Investments have been a bright spot for the P&C industry—including MPL carriers—over the past few years. Since interest rates bottomed in the early 2020s, the current interest rate and yield environment has strongly supported investment income, boosting returns for most insurers. Other than 2022, when insurers experienced unique stress in their balance sheets, risk asset performance has been strong, allowing for surplus assets to grow.1

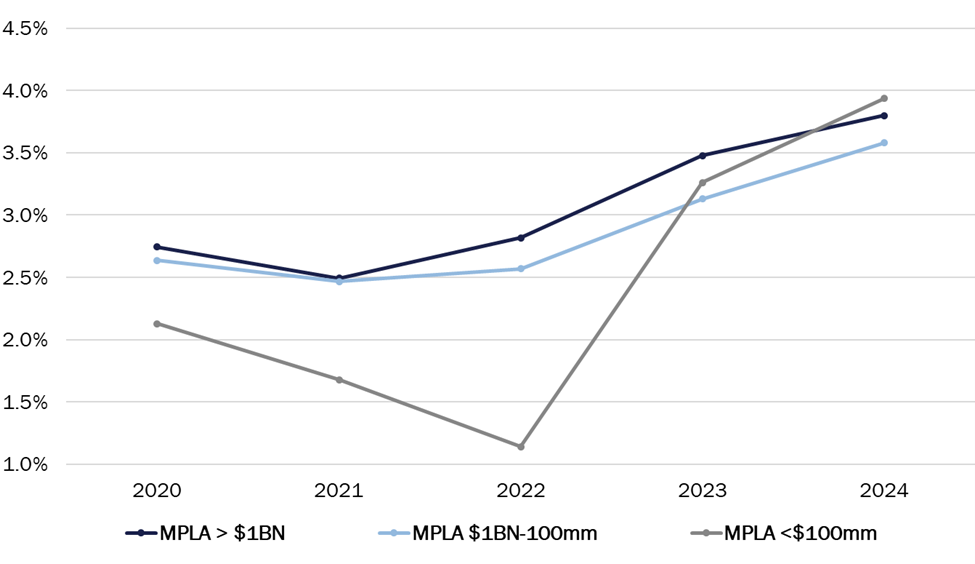

On the credit side, there have been bouts of volatility but an overall supportive environment with minimal credit losses for insurers to contend with. Figure 2 demonstrates the rise in investment yields experienced by many members with average yields increasing by more than 1% from 2022 to 2024—an improvement achieved in less than two years.

Figure 2. Estimated Tax-Equivalent Gross Investment Yield by MPL Association Member Size Cohort

Prepared by Conning, Inc. Source: Copyright 2025 S&P Global Market Intelligence LLC

High interest rates have benefitted the portfolio yields of smaller insurers more than their larger counterparts, however, when looking at performance in a more holistic fashion such as examining total return, the field is tilted towards the larger MPL carriers, as illustrated in Figure 3.2 Except for 2022, strong returns are present across the cohort of companies with the median five-year total return of 3.1%. These strong returns have contributed significantly to the 2.5% median surplus growth over the past five years, a period when underwriting results have been lackluster.

Figure 3. Estimate Total Returns by MPL Association Member Size Cohort

Prepared by Conning, Inc. Source: Copyright 2025 S&P Global Market Intelligence LLC

What’s led to such a turnaround in yields? Are carriers doing something different? Is it purely market driven? While any investor would like to take credit for such results, the market deserves much recognition. Still, carriers have played their part by actively adjusting their portfolios.

Similar to other insurers, MPL carriers are looking at newer segments of the market to enhance yield, increase diversification, and strengthen the overall resilience of their portfolios. One area that has attracted particular interest from carriers is less-liquid investments that may not be freely tradeable. Allocations to both 144A securities and True Private Placements in MPL insurers portfolios have doubled from 6% of their bond portfolios to 12% over the past five years. These securities can include private corporate credit, collateralized loan obligations (CLOs), and certain asset-backed securities (ABS) that are less frequently accessed by investors and can provide a yield premium. These investments can be costly to liquidate, making them less suitable for insurers with short-term liabilities but a potentially good match for MPL carriers.

A large proportion of those allocations is coming from investment grade true private placements. There are several MPL carriers with mid-to-high single-digit allocations to these types of bonds. Typically, these are providing insurers with a significant yield premium to public securities to compensate for liquidity and can come with better covenants (investor protections) and provide exposure to issuers or industries that do not typically finance in the public markets (sports leagues are a well-known example).

Growing Allocations to Structured Securities

One of the other major shifts that we have seen is the increased usage of structured securities in portfolios. Figure 4 illustrates the different allocations across size cohorts for 2019 and 2024-year ends. Following corporate tax reform, the value of municipal bonds dropped significantly on an after-tax basis. However, for years, they provided a significant portion of highly rated bond investments with stable income for the portfolio. To help offset the declines we have seen in this sector, insurers, including MPL carriers, have turned to structured securities to enhance their portfolio while maintaining high credit quality.

Figure 4. Select Changes to Bond Sector Portfolio Allocations

Prepared by Conning, Inc. Source: Copyright 2025 S&P Global Market Intelligence LLC

Within structured securities, there has been significant growth in a few specific parts of the market. Non-agency MBS has grown significantly on many insurers’ balance sheets and can provide attractive yields with AAA or similar ratings. CLOs have been a growing allocation for the past several years in insurers’ portfolios. Notably, many companies are looking to enhance their CLO allocation by moving down the credit spectrum. As an example, an insurer who previously purchased only AAA- or AA-rated CLOs might now look to add A- and BBB-rated CLOs to enhance yield further.

While asset-backed securities have long held a place in insurer’s portfolios, one growing area has been in less traditional or esoteric ABS. Instead of more traditional collateral such as auto loans or credit cards receivables, these securities can back a wide range of less traditional cash flows. A few examples include leases for commercial jets, containers for shipping, or music royalties. This market has grown to be over $300 billion and provides an attractive yield profile, investment grade ratings with typically short durations and strong diversification characteristics.

Assessing Portfolio Alternatives

Given the challenging underwriting environment ahead, we believe MPL carriers should leverage the strength of recent investment market performance. The rising yield environment of the past several years has been a tailwind to investment income for carriers. Now, as the future of rates is less certain and the possibility of falling yields is increasing, diversifying and locking in yield premiums we believe is prudent.

Ensuring that new or growing investment allocations are approached in a holistic manner and remain supportive of the enterprise’s goal should be the primary focus. Ensuring that new strategies provide adequate projected returns to compensate for any additional risks is critical. Credit risk, liquidity, and asset price volatility should remain key items for MPL carriers to review to ensure a strong long-term investment strategy.